Removal of Philippine Travel Tax Proposed

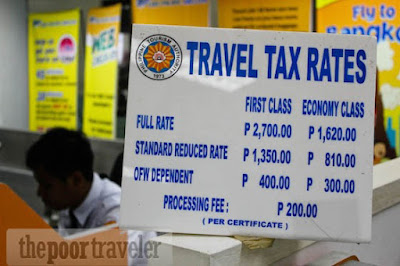

The Department of Tourism is exploring the possibility of removing or reducing the Philippine Travel Tax in an effort to make travel more affordable for Filipinos. At present, Philippine passport holders are assessed a tax of P1,620 for those seated in economy class, while first class passengers are charged P2,700. The tax is imposed on passengers leaving the Philippines irrespective of their destination.

|

| Image Source: The Poor Traveler |

Citizens of the Philippines are required to pay the tax, along with foreign passport holders under special circumstances. However, the travel tax does not apply to all Filipinos and there are exemptions for overseas workers and permanent residents of other countries. In addition, a reduced travel tax is available to dependants of overseas Filipino workers.

According to Tourism Undersecretary Katherine De Castro, the Department is currently reviewing the travel tax system to identify if there is an opportunity to either reduce the tax or remove it altogether.

"It still needs a lot of review. It's an ambitious part from the end of the DOT," said De Castro in an interview with the Philippine Star. "Travelling in the Philippines is not cheap. If we can't remove it totally, we want to at least lower it."

Proceeds of the travel tax are currently split between the Tourism Infrastructure and Enterprise Zone Authority, the Commission on Higher Education, and the National Commission for Culture and Arts. "We're looking at the fact that a percentage of the travel tax goes to the Commission on Higher Education, which is in no way connected to travelling at all," added De Castro.

To date, the Department of Tourism has removed the P200 processing fee assessed for the issuance of Travel Tax Exemption and Reduced Travel Tax certificates, which came into effect on July 25. In addition, the Department would like to see the travel tax incorporated into airline tickets similarly to the passenger terminal fee at select airports in the Philippines.

De Castro noted that all carriers will be expected to incorporate the fee into their tickets, regardless if they are a full-service or low-cost carrier. "It's inconvenient in such a way that you think you're already checked in, but in fact, you are not, so you would still have to line up in another booth to pay for your travel tax."

This comment has been removed by the author.

ReplyDeleteThis is an interesting development by the Department of Tourism! Reducing or removing the Philippine Travel Tax could certainly make travel more accessible for many Filipinos. It's always great to see initiatives that prioritize affordability and encourage more people to explore the world. On a related note, for businesses and individuals navigating financial obligations, especially abroad, finding the right Tax services in US can be incredibly beneficial. Proper tax planning and management ensure you're compliant with international tax regulations while maximizing savings, much like how easing travel taxes can benefit travelers.

ReplyDeleteClear skin is achievable through laser removal. Tattoo removal austin

ReplyDelete